Deferral functionalities include data conversion, improvements with customizing reports in Word for different customers and different billing media, positive pay, and posting previews, to name a few. Today, to aid CFO’s and controllers, we will discuss the deferral functionality in NAV 2016.

Deferral functionalities allow the user to automate the process of deferring revenues and expenses over a pre-defined schedule. This is available for sales and purchasing documents, as well as general journals.

The deferrals can be set up on:

- General Journals

- Sales: Sales invoices, sales credit memos, sales orders, and sales return orders

- Purchasing: Purchase invoices, purchase credit memos, purchase orders, and purchase return orders

Set-up

The deferrals can be set up in numerous fashions allowing for any scenario; the set-up choices include:

- Straight-line, pro-rated to number of days of deferral

- Equal per period, very strict

- Days per period

- User defined

Posting restrictions on deferrals are honored, and you may use deferrals after an item is posted, but only in the general journal; it wouldn’t tie in to the document after posting.

Can it work on my accounting periods?

Yes, deferrals can do a 4-4-5 schedule, as the scheduling is based on your accounting periods. So, companies who divide each quarter into 5-4-4 weeks or 4-5-4 weeks can do deferrals based on their needs.

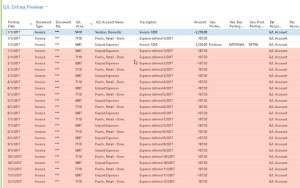

What is most exciting about the deferrals posting is its visibility in reporting, but also once the deferral is set up, it's automated. . .making your job easier.

Our advice to CFO's who want deferrals for revenue & expenses is to implement NAV 2016.

To discuss NAV or schedule a demo with a partner, call us at 800.331.8382, or email sales.

Advice To CFO's Who Want Deferrals For Revenue & Expenses">

Advice To CFO's Who Want Deferrals For Revenue & Expenses">